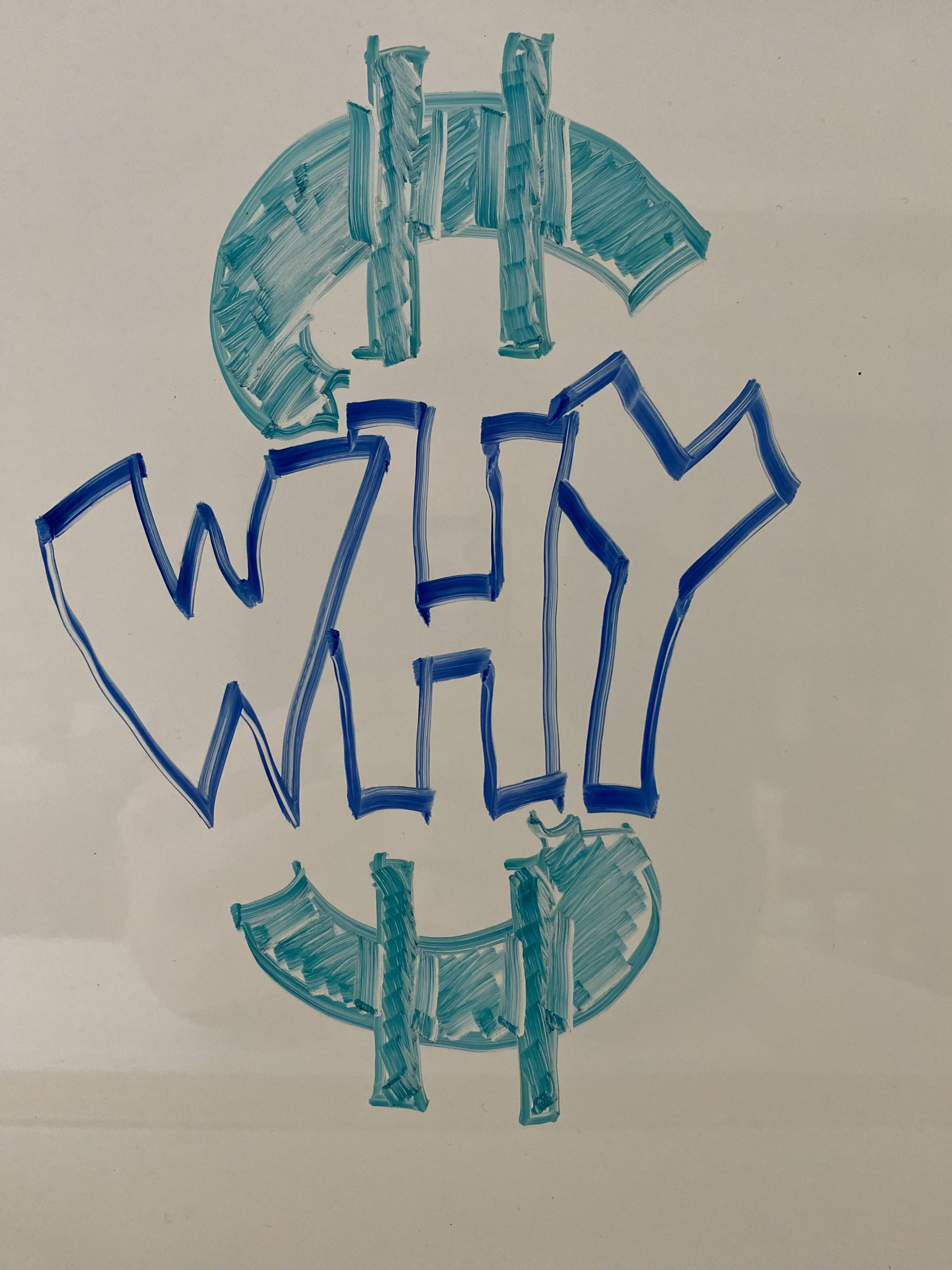

Knowing your “WHY” is like igniting a rocket engine inside your finances Personal Management Start With Why

“If you know and live within your “why”, it is easier to say “no” to things that don’t fit and to live within your budget.” -Trent D. Schrock

First, what is a WHY? And why is it so important?

Everyone has a “WHY”, a central belief, a main motivation, a raison d’etre. Our “Why” acts as a powerful engine within us, driving us forward even when we don’t know our own best motives. It usually looks something like this… “God has gifted me in this way, and this is how I wish to honor Him, follow Christ, and help others.” Knowing our personal WHY can help us make better decisions that align with our lifelong aims.

Now, how does our WHY relate to our personal finances:

A common reaction when people hear the word “budget” is somewhere between a moan and a silent cringe. It just sounds too restrictive, and no one likes to feel restricted. In fact, we like to justify poor money management. But gravity is gravity and math is math. If we spend more than we make, it will eventually catch up to us.

On the other hand if we play great defense and spend less than our income, the extra money can become a useful tool in accomplishing our WHY.

To make better financial decisions, begin by knowing your “WHY”.

Ask yourself questions such as these:

- What is my calling in life, the way I’ve been gifted to serve God and help others?

- Where do I want to be in a year to fulfill that calling?

- In ten years? At retirement?

- How does my money play a role as a tool in accomplishing that future?

Perhaps the bottom-line question is, “WHY do I need money?” Answer this first. Then begin to aim that rocket engine by dialing it in with a budget.

I’ve heard it said to start a budget with giving. I agree. I’ve found this to be a good place to begin. It reminds me who my resources are from and where they belong.

Then of course, we all need basics such as shelter, food, utilities, and transportation. Place these in your budget.

Once these are covered, any money that remains can be applied to your raison d’erte.

Our spending habits will make our values clear, both to ourselves and to others.

Ouch. Let me say that again.

Our spending habits will make our values clear to all who see. We often let our money “happen to us” instead of taking our money in hand as a tool and putting it to use toward the things that matter most. So knowing our WHY helps us prioritize how much of our money flows into each category, and how much we apply to our life mission.

- If your WHY is to impact the world through your own business someday, how can you employ that powerful motivation to say “yes” to the right kinds of savings and “no” to detracting spending?

- If your WHY is to give back to others in some way, how can you invest your money to make a difference?

- If you believe in your daily work as a great way to bless others, if your WHY is to bring excellence to your work, how can you invest your money to bring peak performance to your job?

- If your WHY is to marry and raise a family, how should your money be managed today?

- If you love to entertain, how can your WHY be used to create a peaceful space people love to visit, and how can you invest your money to make hospitality easier so you can do more of it?

- If your WHY is to travel or explore or learn or write or paint, how much money do you need to sustain these endeavors?

In conclusion, having a plan in the form of a budget, and shaping that budget around our highest values and goals, helps us stay on track with our budget and say “no” to things that don’t fit our WHY.